Consider the typical billing process workflow in a law firm and what stages it may consist of:

1. The lawyer takes a new client matter

2. Logs in case activities (billable) and add applicable fees

3. Makes a draft of an invoice and adjusts it during the legal case process

4. Approves the final payment at the end of the deal

5. Sends out the final version of a bill to the client

6. The client pays through the chosen payment method

However, accounting may not run as efficiently and easily as it sounds. Pitfalls can occur if creating invoices manually, such as data input errors, missing client details, simple human errors, or delayed bills. This can result in payment issues and worsen the law firm’s revenue.

Legal specialists should balance between reasonably charging their clients for providing legal services and not letting the billing process become a pain in the neck. However, you won’t be able to manage your successful legal practice without strict billing methods and a proper compensation system for legal staff to keep your law firm running. We compiled some recommendations for lawyers on how to institute appropriate billing habits and effectively charge clients.

Enforce a billing policy

Billing procedure is hardly the most enjoyable part for clients. Still, by embracing accurate billing rules and habits, you can simplify and manage payments without creating a wheel whenever invoicing a client.

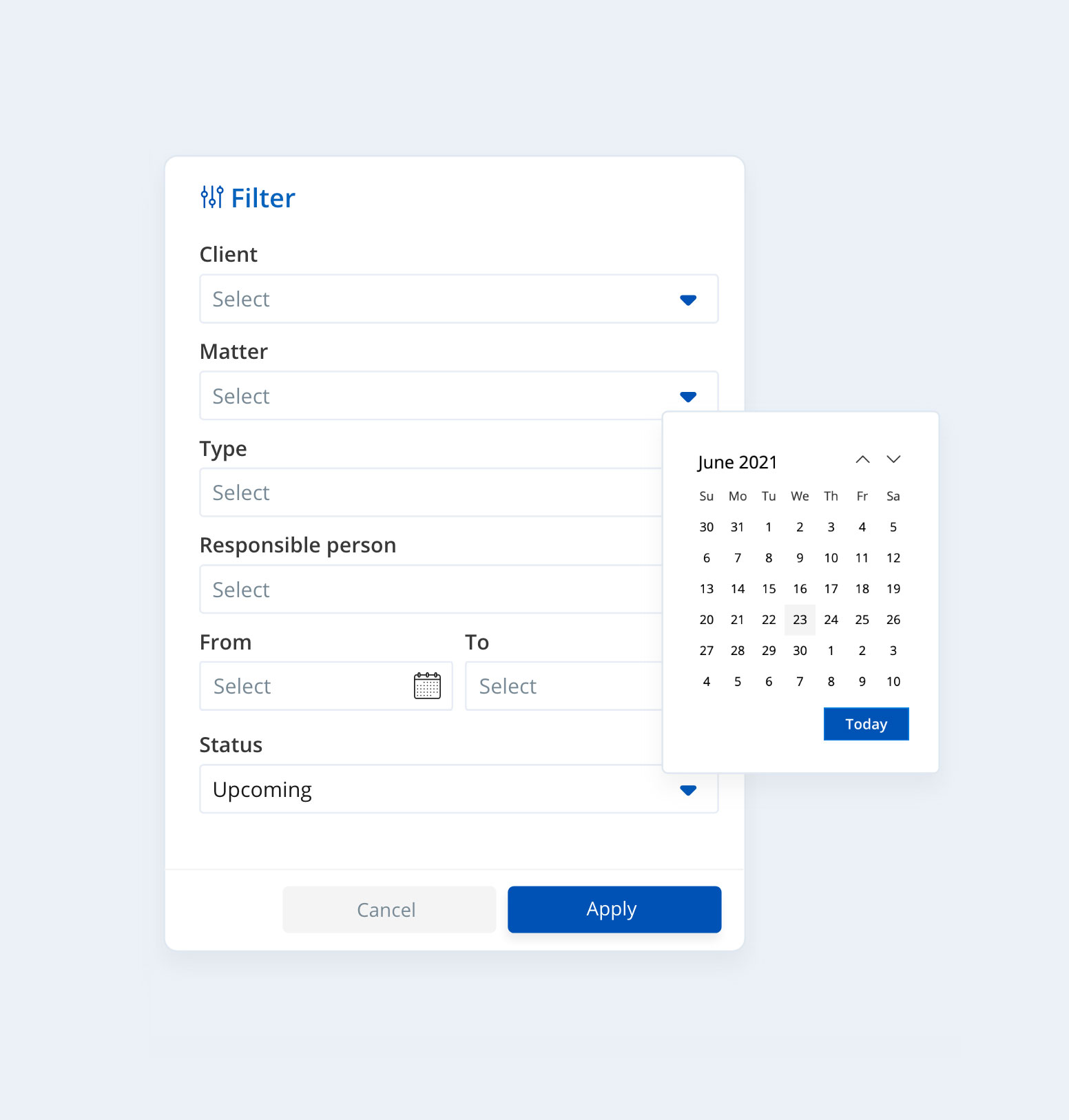

From the first day of partnership, let your clients know how you bill for your legal performance and present your clients with the documented rules that may include responses to questions, such as:

1. What are the specific dates on what you expect to receive payments?

2. What are the late payment fees?

3. What payment options can clients choose (including online billing options)?

4. Are there any payment methods that are prohibited in your firm?

5. What are the ways your clients can contact you?

Set policies for late and early payments

It’s essential to document whether you include interest on late charges and, if so, what sum clients are expected to pay if they pass the due date. For example, you may add an extra 2% to 5% to the late bill.

A great way to make your payment flow more efficient and motivate your clients to pay on time is to add a bonus system or provide discounts for those who pay earlier than they are supposed to. For example, your clients have 30 days to pay off the bill for legal services. Your firm can cut 5% of their bill if they pay during the first seven days.

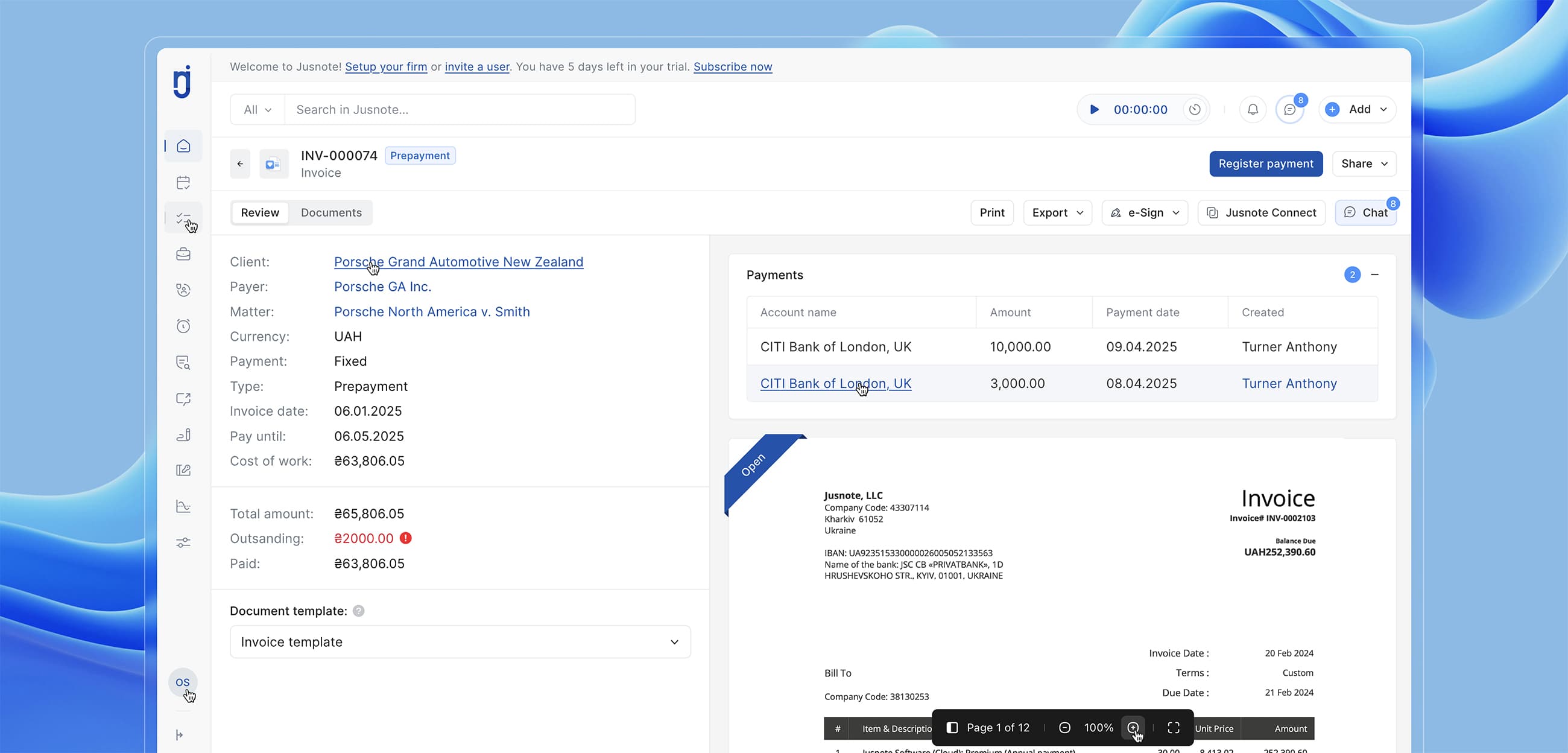

Professionally craft your invoices

Professionally generated invoices can help earn trust in your law firm or practice and avoid client disputes regarding the amount of payment.

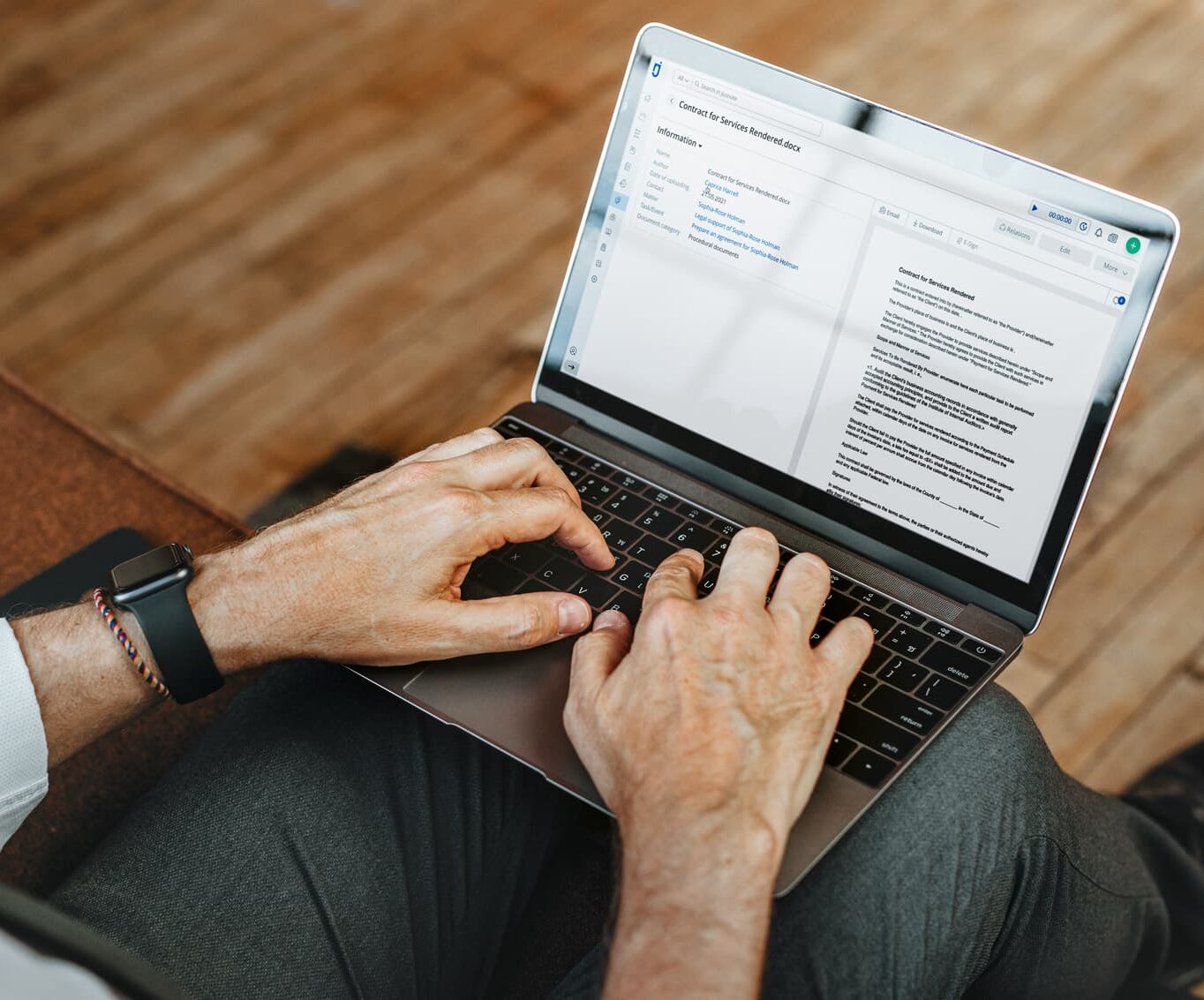

Apart from the total sum set for your services, there should be a detailed description of every service and how much time a lawyer spent handling those deals. This way, clients can see what they pay for. To create professional invoices, complete the following steps:

1. Put your law firm’s logo

2. Include your firm’s contact information, such as your law firm’s name, address, email, and phone number

3. Ensure to add the correct client details to avoid payment inaccuracies and delays

4. Add the valid payment due date

5. Include precise descriptions of the delivered services

6. Count all your billable hours

7. Add the total cost to be paid, including taxes

8. Document your billing terms, such as precise rules on how clients should pay for your services

9. Automate the process of sending invoices to clients and reminders in case of overdue invoices.

Note: by creating invoices with detailed and informative descriptions of your law services, you mitigate the number of client disputes and risks of late or no payments. There shouldn’t be too much information; a few sentences up to a point are enough.

Send invoices on time

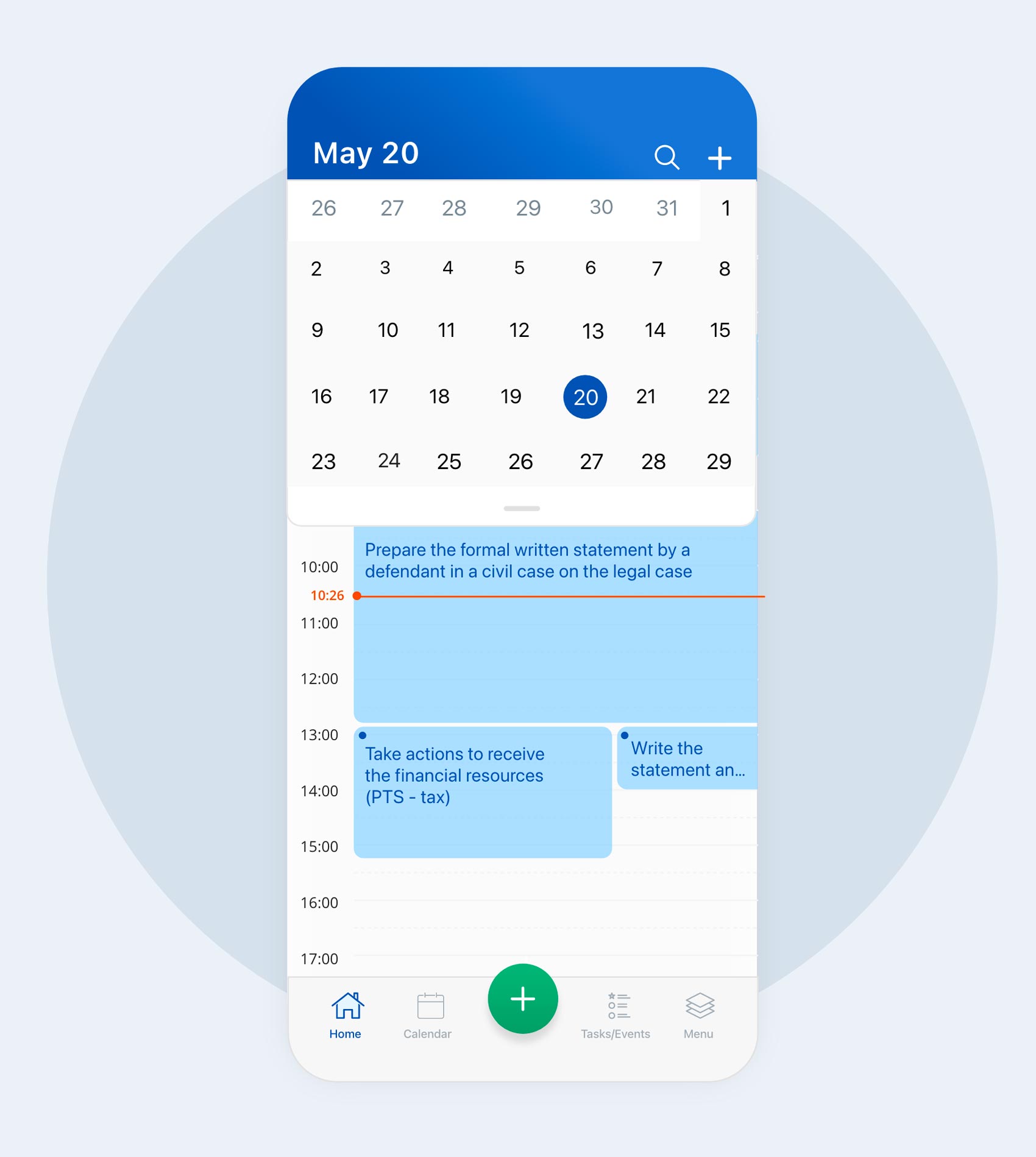

With a billing policy in place, you can set specific dates for issuing bills. Adhering to a routine billing schedule can help you stay organized and satisfy your clients more. Bills that are sent too late can lead to payment inaccuracies, confuse the client, and result in a lack of trust in your firm.

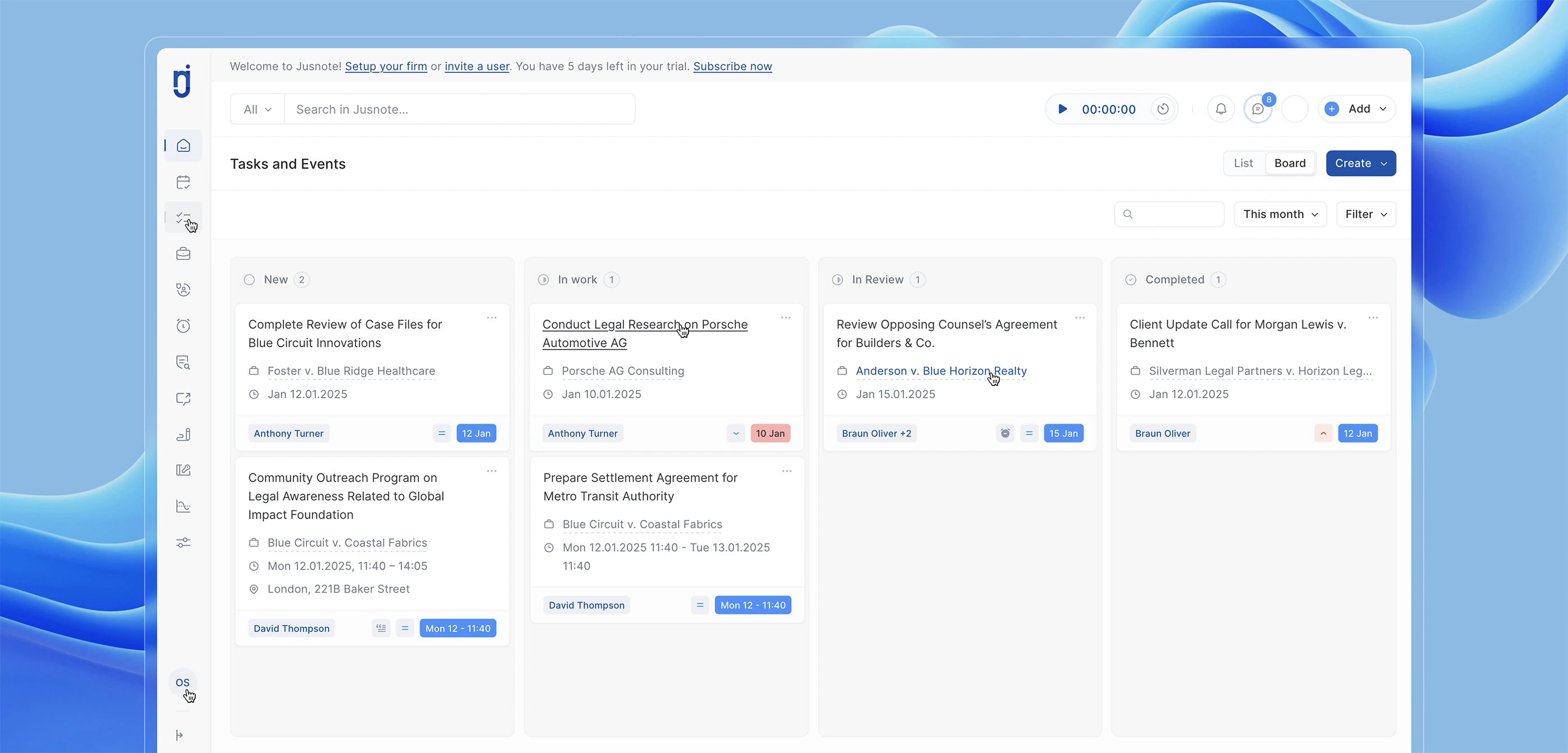

Create regular legal reports to track your finances

Reporting allows lawyers to fill gaps in their billing policy and enforce adjustments to make billing management more efficient and improve financial revenue. By checking and analyzing your legal reports, you can see whether all actual working time is billed per your payment guidelines.

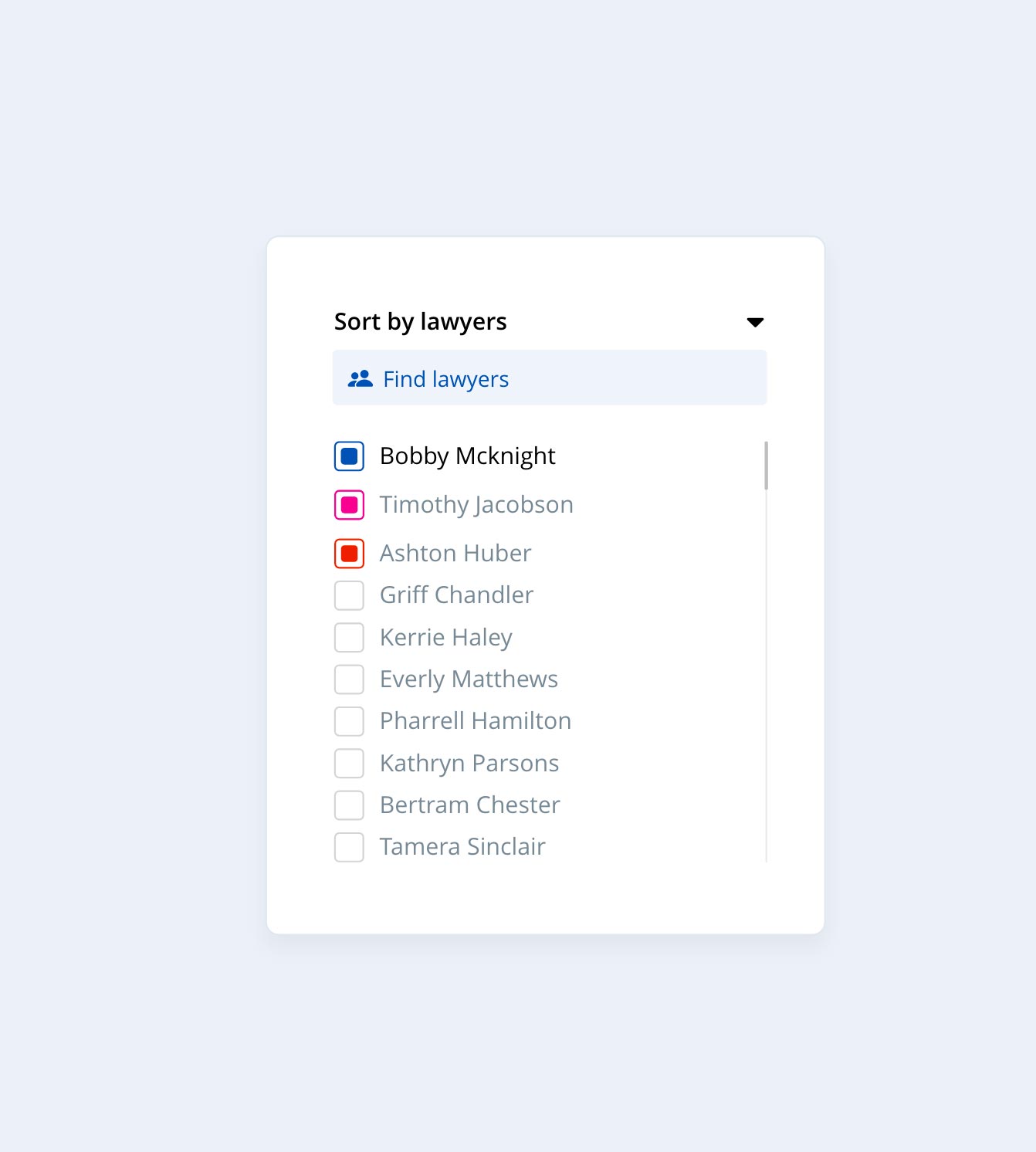

Lawyers can have clear insight into the progress of their legal operations and track their income daily, weekly, and monthly. For example, if one area of law lags behind, you may hire a new, highly-skilled lawyer or a paralegal to take on more successful client cases and increase revenue.

Also, if your income has dropped in a particular month, you can see that decline in a report and analyze the possible reasons. As a result, you will better keep track of your current and expected costs and plan your future budget. For example, if you run a law firm, you can check how much time your employee spent on a particular client deal during the last month and compare this time with the client’s costs for legal support.

Besides income analysis, analytics allows law specialists to make better decisions and set long-term goals. This can show you the following:

• the ratio between highly and less valued legal services

• what legal services are more in demand

• what tasks can be automated to ease lawyers’ workload

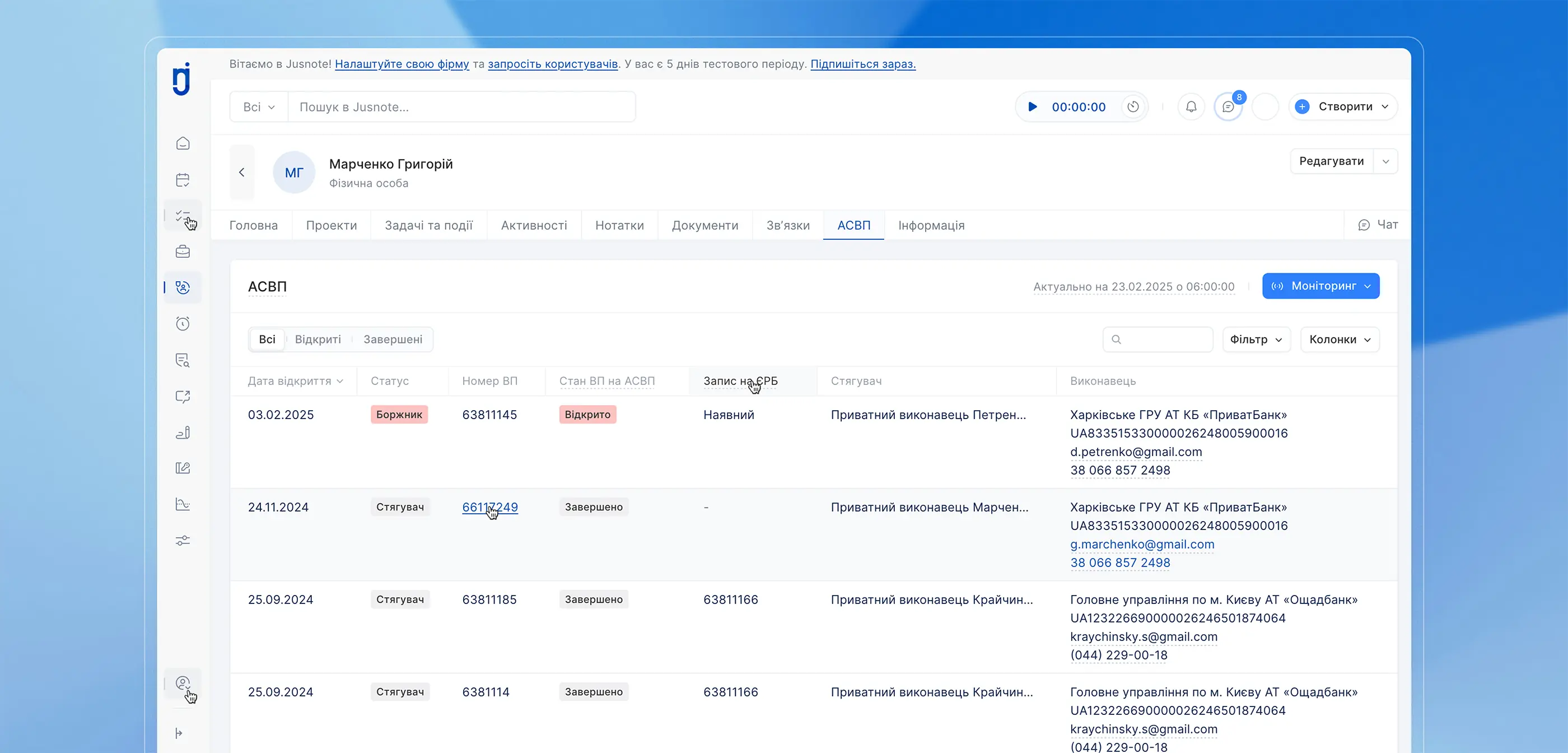

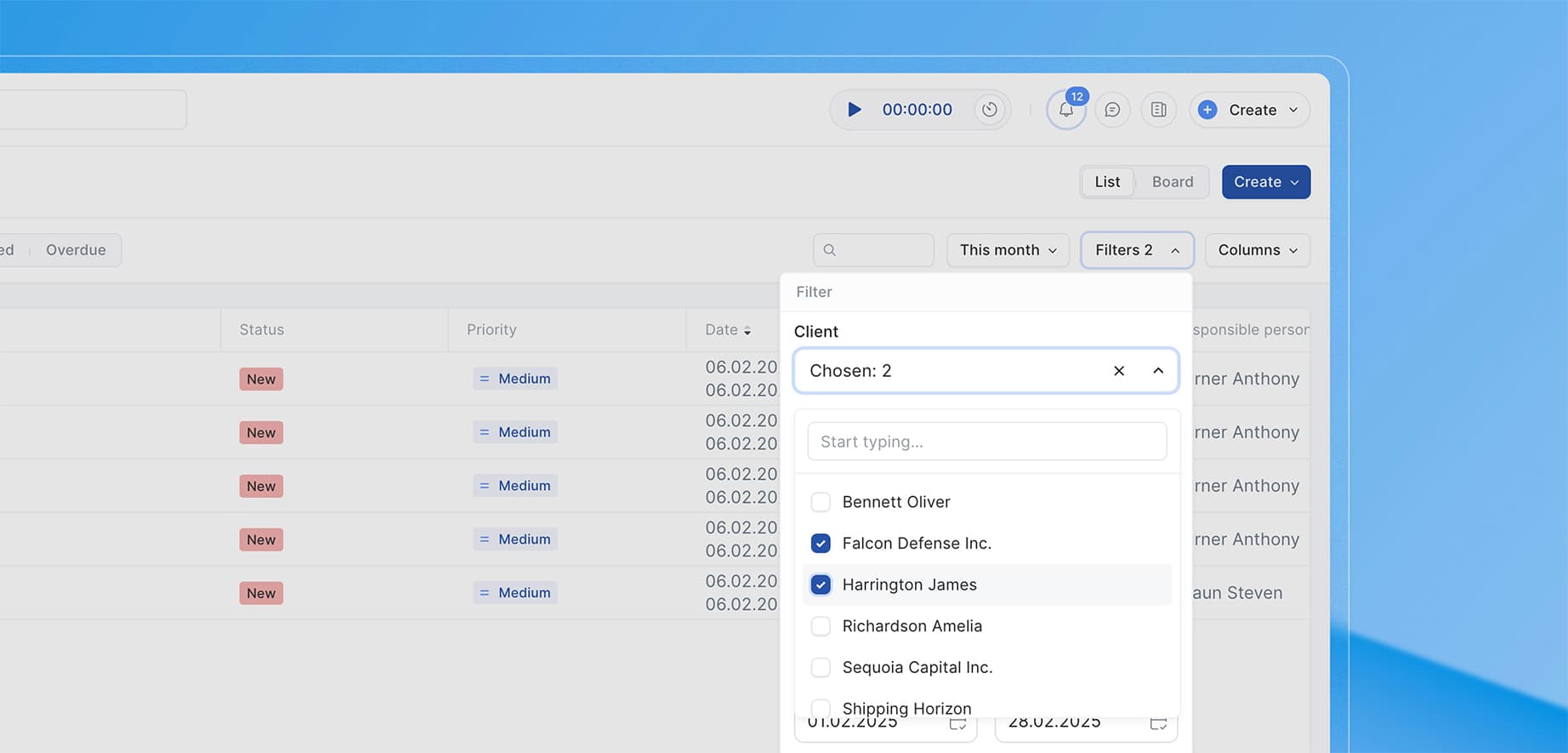

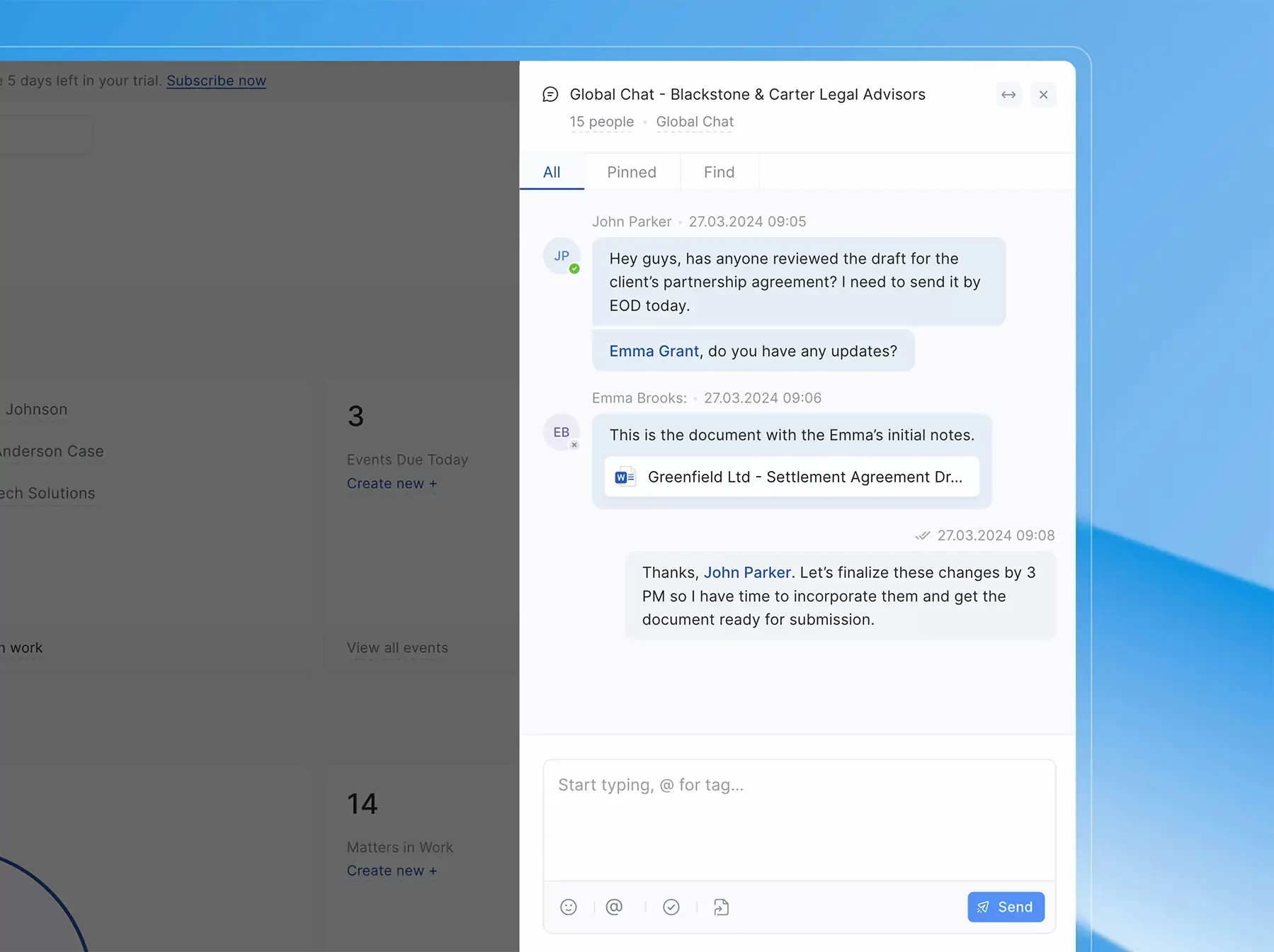

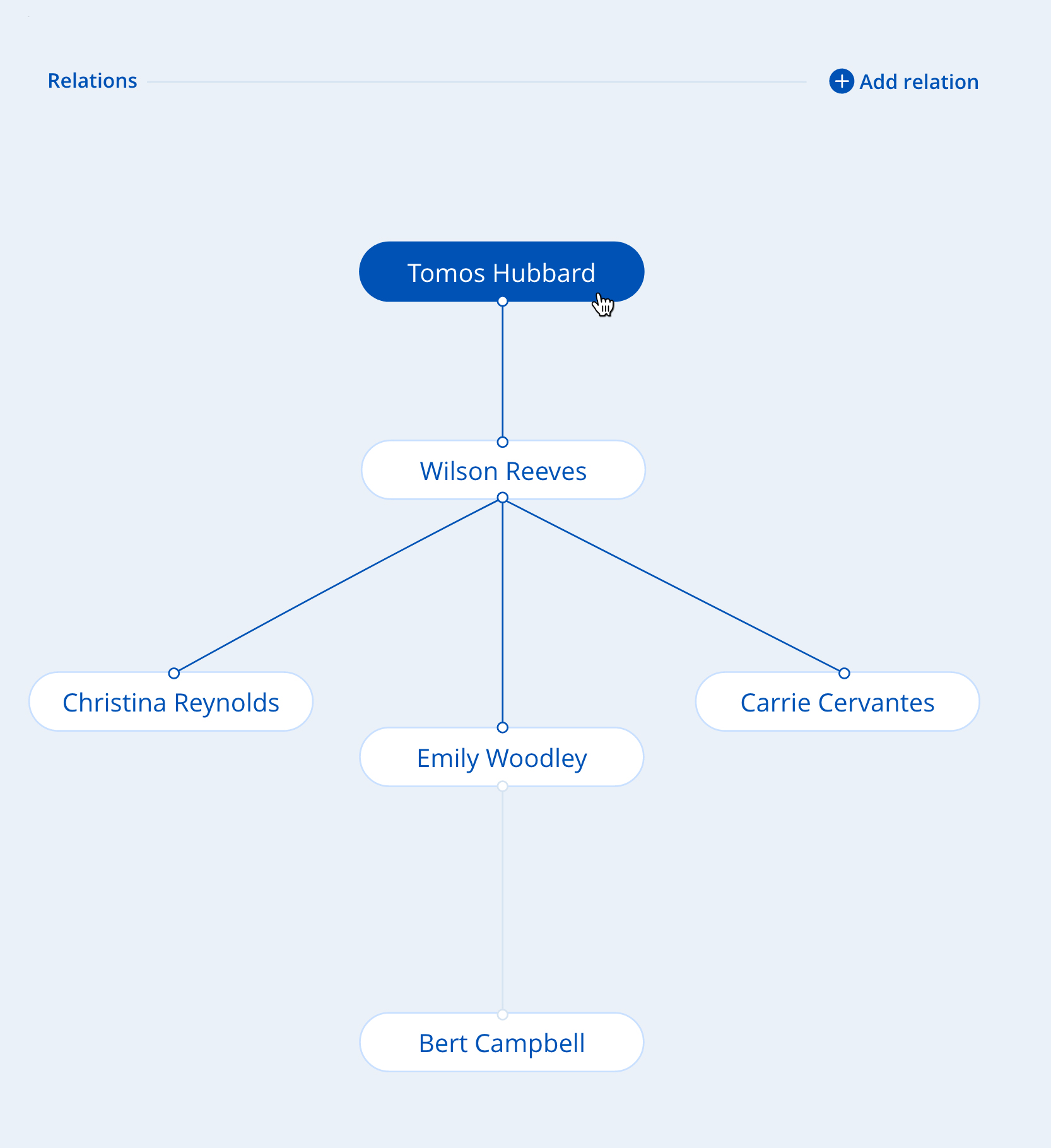

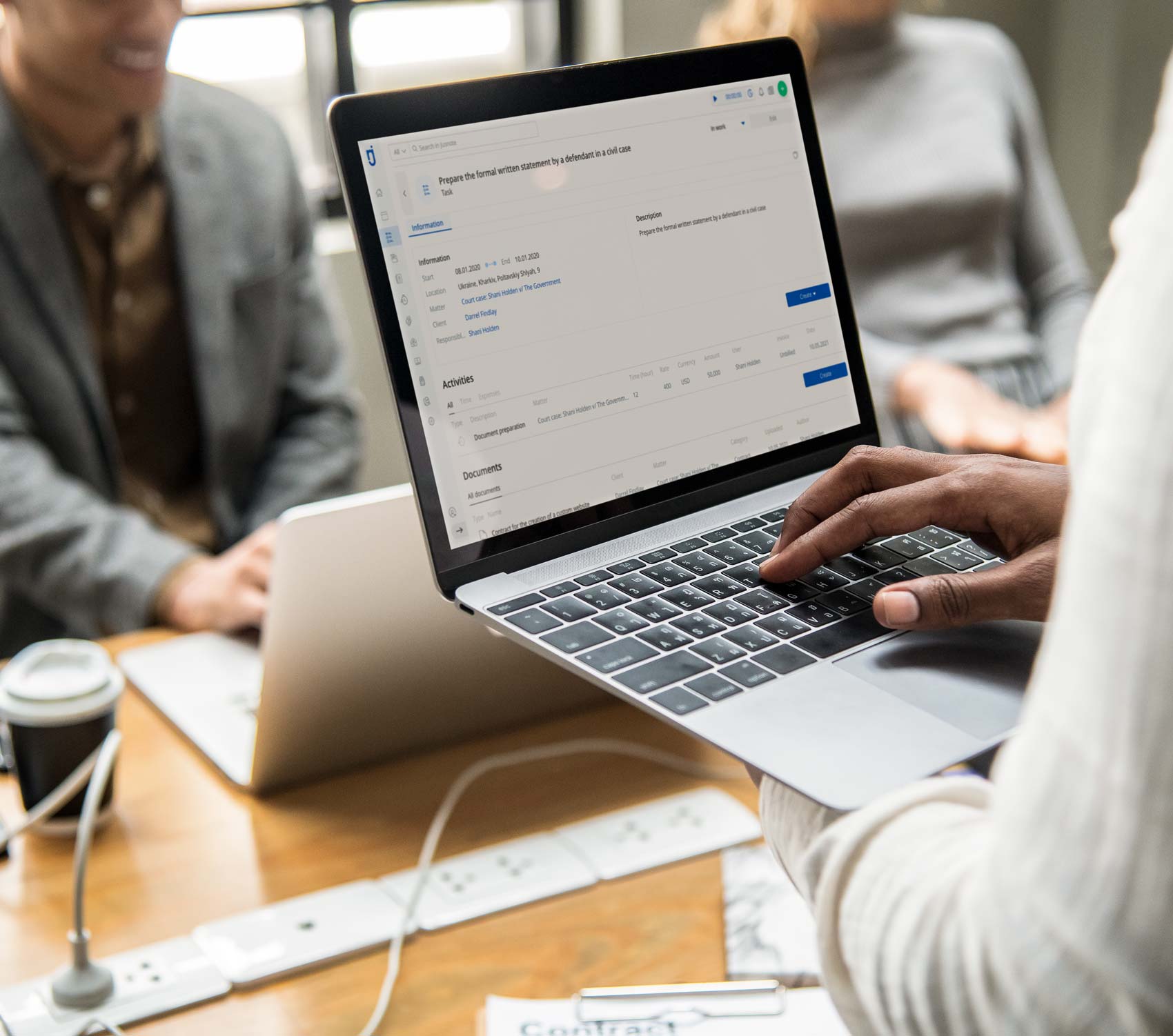

Professional legal software such as Jusnote helps you translate raw facts and numbers into informative data by generating real-time automated reporting. That means you minimize your financial risks and increase productivity by having a bird-eye view of all aspects of your law practice’s management.

A few final thoughts

Law firms’ accounting procedures can affect relationships with clients, either weakening or improving cooperation, which depends on how convenient the billing experience is for clients. So automating this process must be among your top priorities.

Developing billing policies is a crucial thing to start with. However, to fully automate your financial flows, you should choose trusted technology to rely on.

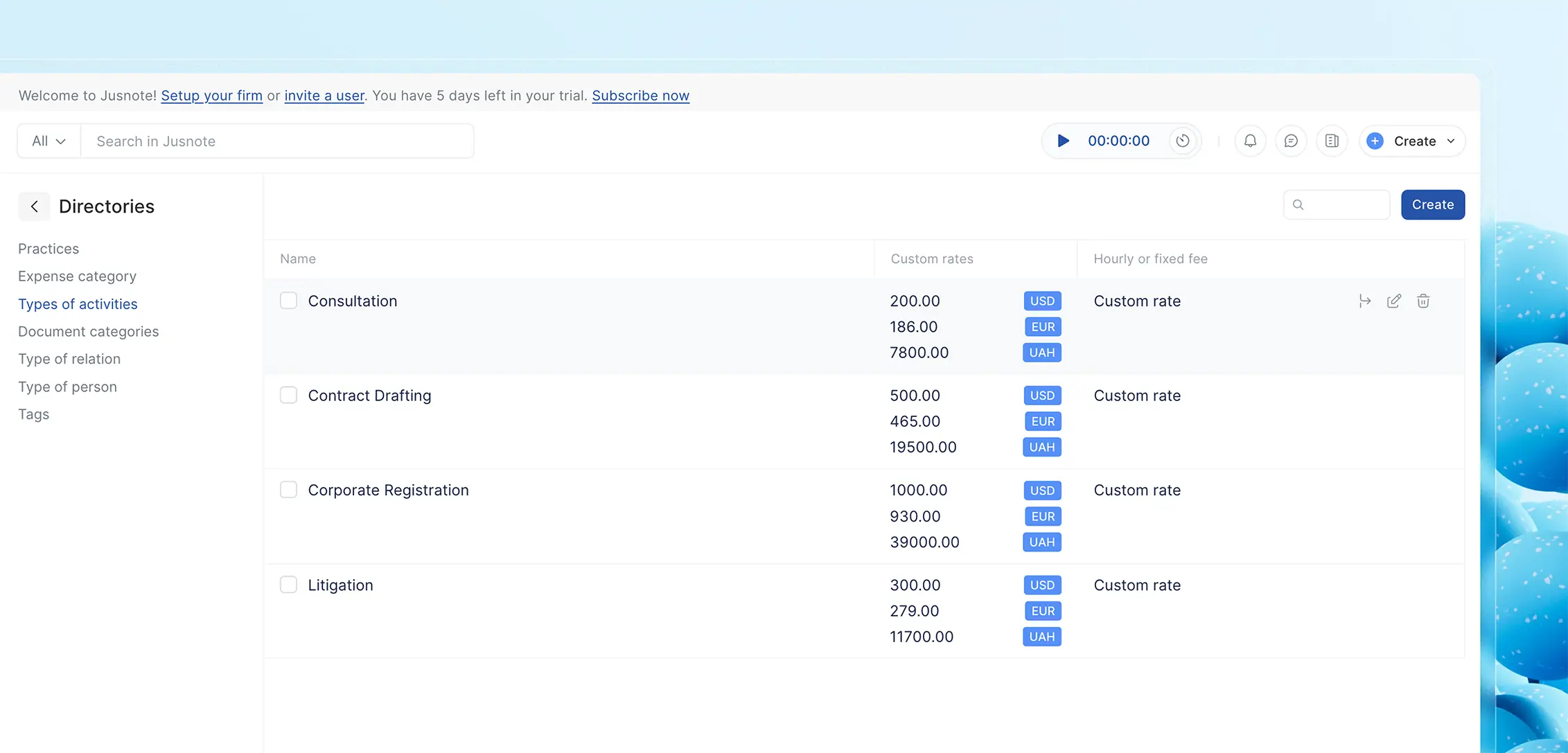

Professional legal software can help you achieve your financial goals faster and more efficiently. You will no longer need to install and use third-party billing systems. Jusnote enables law specialists to bill clients in a few clicks with the help of time and expense tracking, automated invoicing, in-depth reporting, and other vital functionalities.

Check out some related articles on our website:

1. Intro to law firm billing process

2. Why legal billing software is a must for law firms

![]()

Olena Ivanenko

Author, Content Creator at Jusnote

Jusnote Newsroom

Jusnote Newsroom  Search Newsroom

Search Newsroom

Back to all publications

Back to all publications