Why Time Tracking is Essential for Law Firms

Regardless of whether billing is conducted hourly, at flat rates, or on a contingency basis, client work remains the primary source of revenue for law firms. The more time a firm can dedicate to billable client work, the greater the revenue it can generate. Timely time tracking (billing) is therefore critical to safeguarding the firm’s income and reputation

The Financial Risks of Delayed Time Tracking

Neglecting to track time promptly can lead to significant revenue losses for the firm:

End-of-day billing risks losing 10-15% of billable time due to fading memory of task details.

Next-day billing can result in a 25% loss, as recalling exact time allocations becomes increasingly difficult.

Weekly or later billing may lead to a 50% loss of billable time, as smaller tasks, often highly valued by clients, are likely to go unrecorded.

These inefficiencies directly impact the firm’s revenue and profitability. Implementing a disciplined approach to time tracking and leveraging technology for automation is essential for maintaining financial stability and client trust.

Moreover, recording the time spent by lawyers on client assignments and internal tasks offers several key benefits:

Transparency and Accurate Client Billing

Proper time tracking ensures that the duration of work on each matter is clearly documented, enabling accurate and justified billing. This practice minimizes potential disputes with clients over time spent or the cost of services provided.

Profitability Analysis

Time tracking allows firms to assess the profitability of specific client projects or assignments. This data helps identify resource-intensive, low-profit matters, enabling timely adjustments to client agreements.

Resource Planning

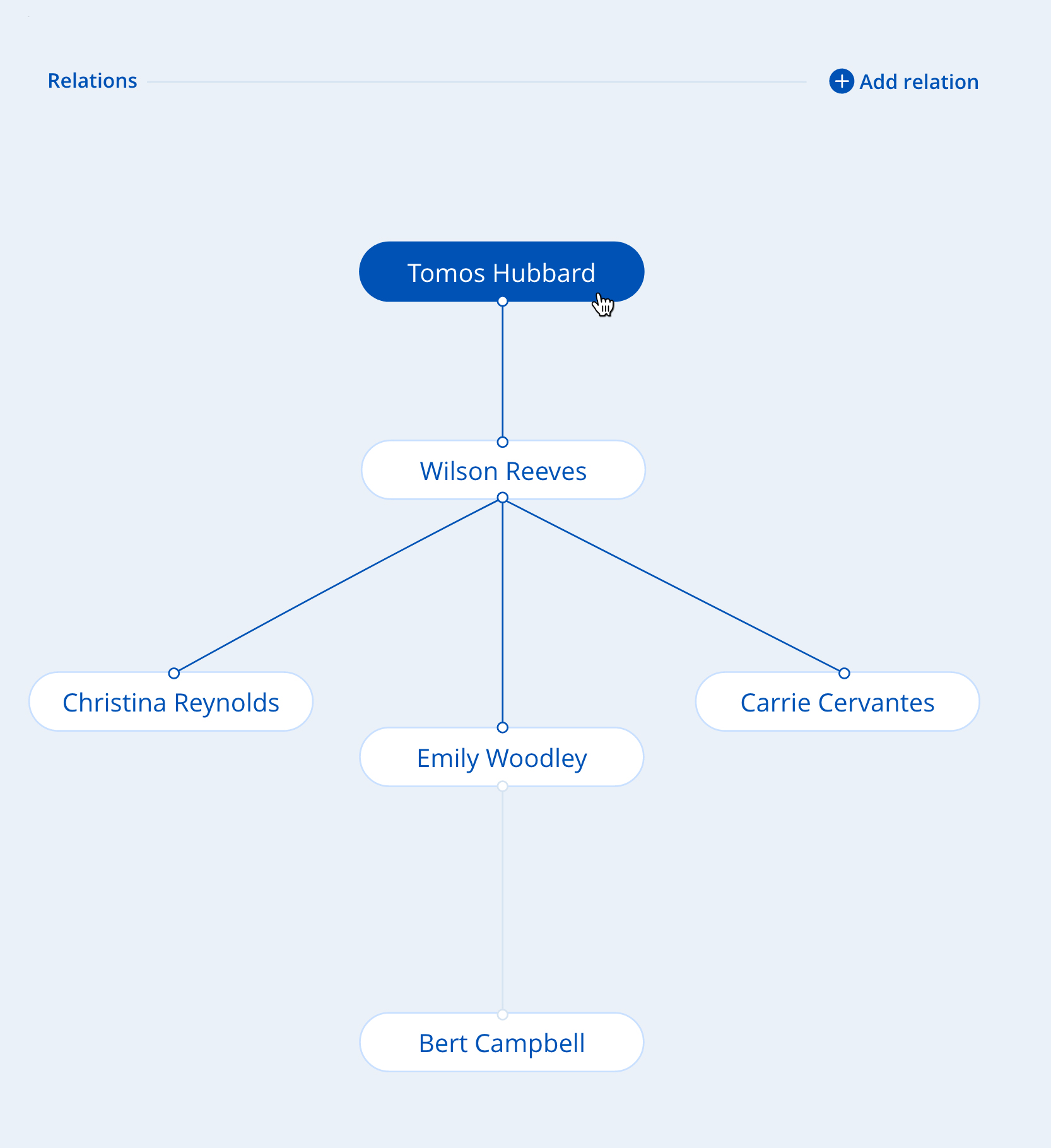

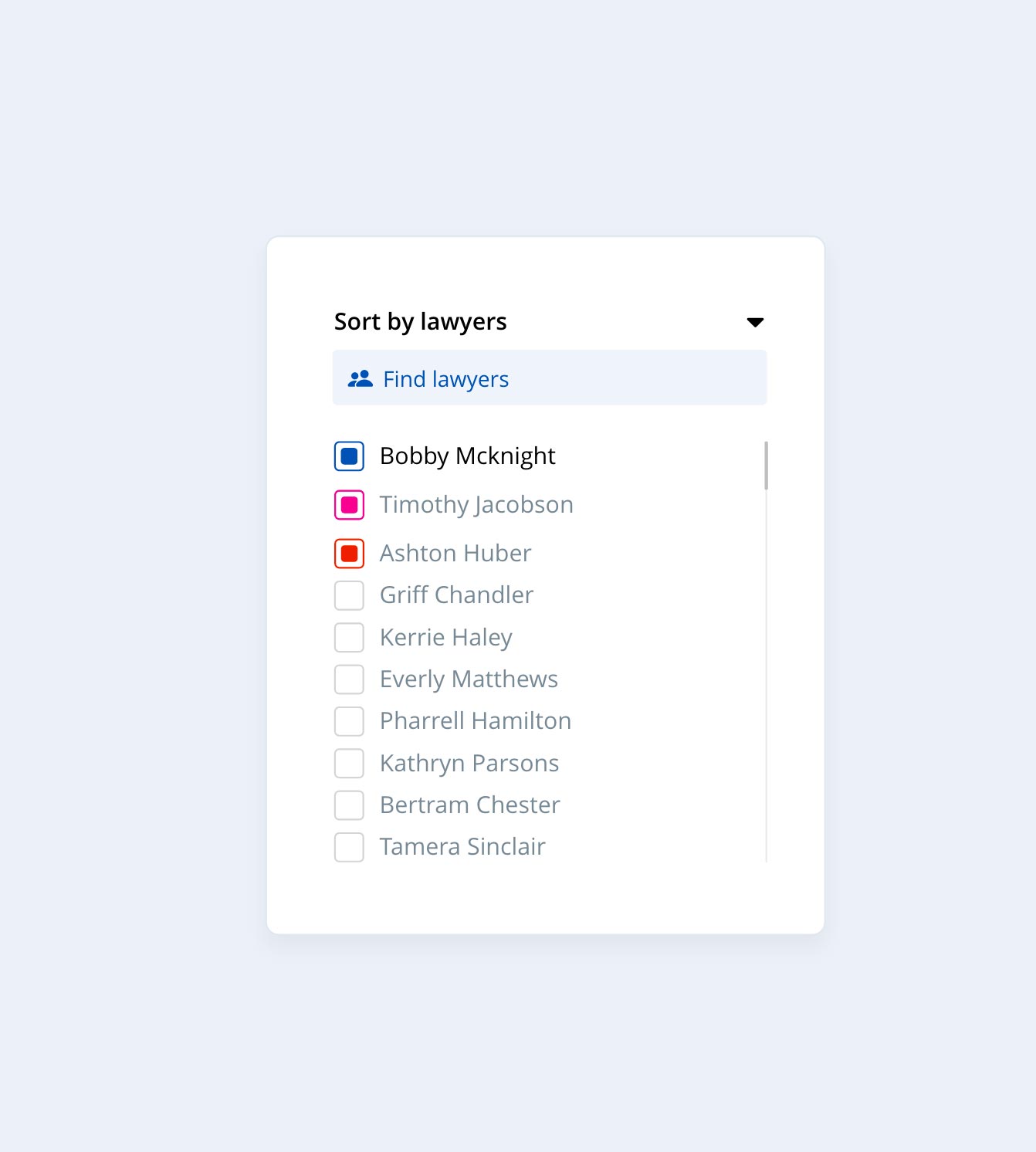

Accurate time records provide insights into team workload, supporting efficient task allocation and preventing employee burnout. Additionally, it helps assess whether additional personnel are required for certain tasks.

Productivity Enhancement

Awareness of the importance of time tracking motivates lawyers to work more efficiently, reducing idle time. It also creates opportunities for performance-based rewards or other incentives.

Proof of Work

In situations where clients question the quality or scope of completed work, detailed time records serve as evidence of a professional and diligent approach.

Internal Analysis and Optimization

Recorded time data enables the firm to identify tasks that consume the most time and implement strategies for optimization or delegation.

Compliance with Legal Standards

In many jurisdictions, time tracking is a mandatory requirement for audits, inspections, or reporting.

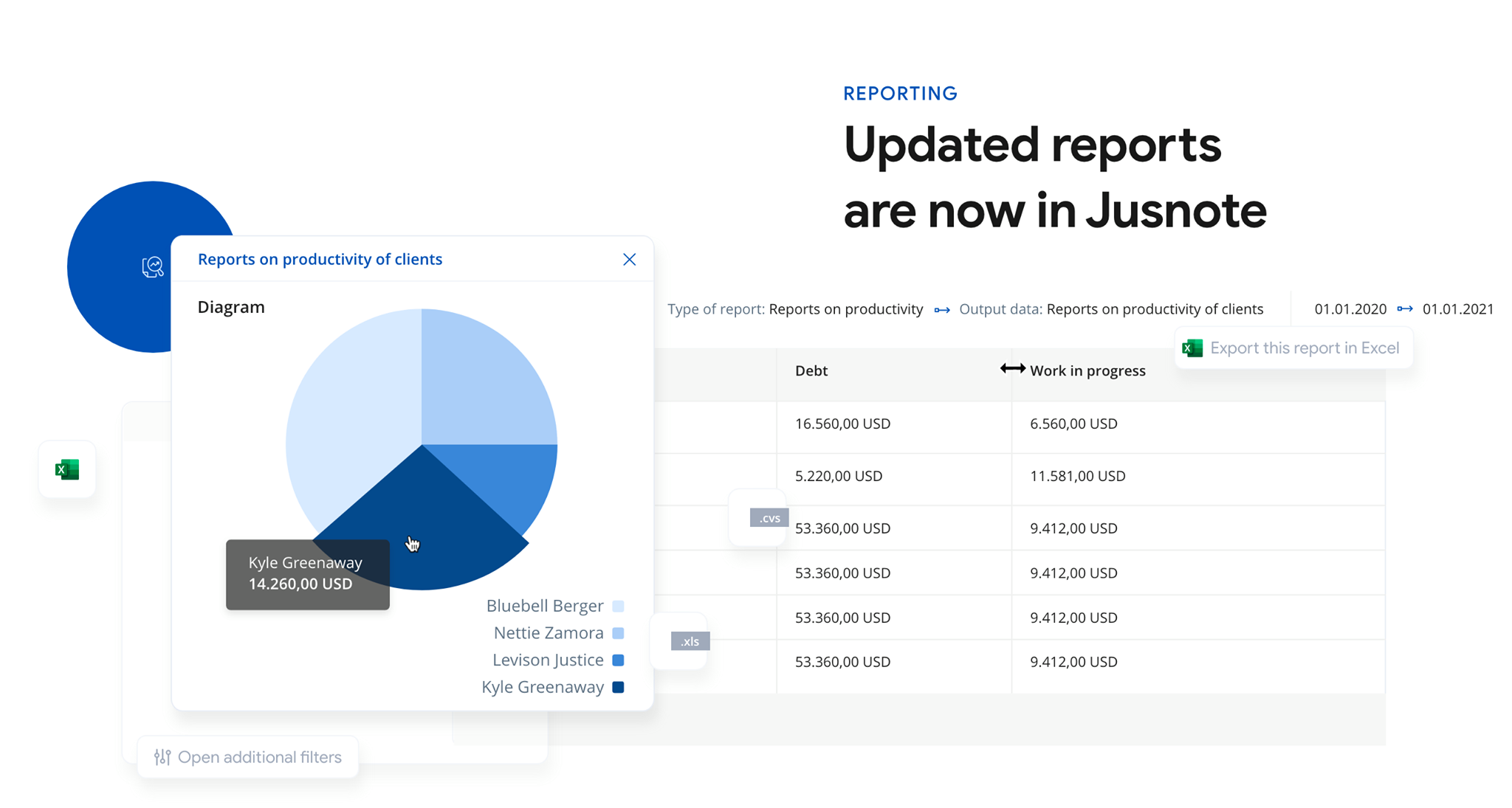

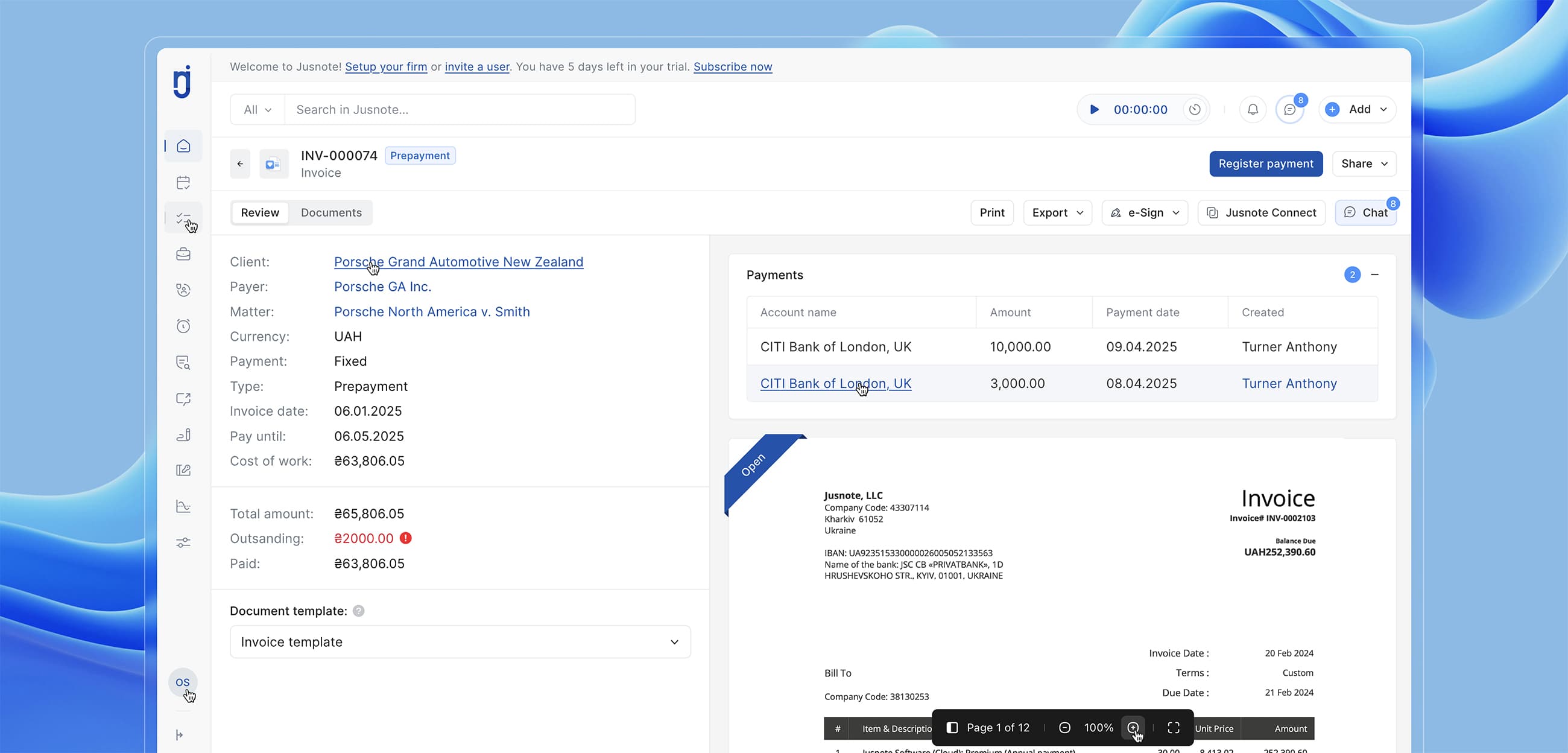

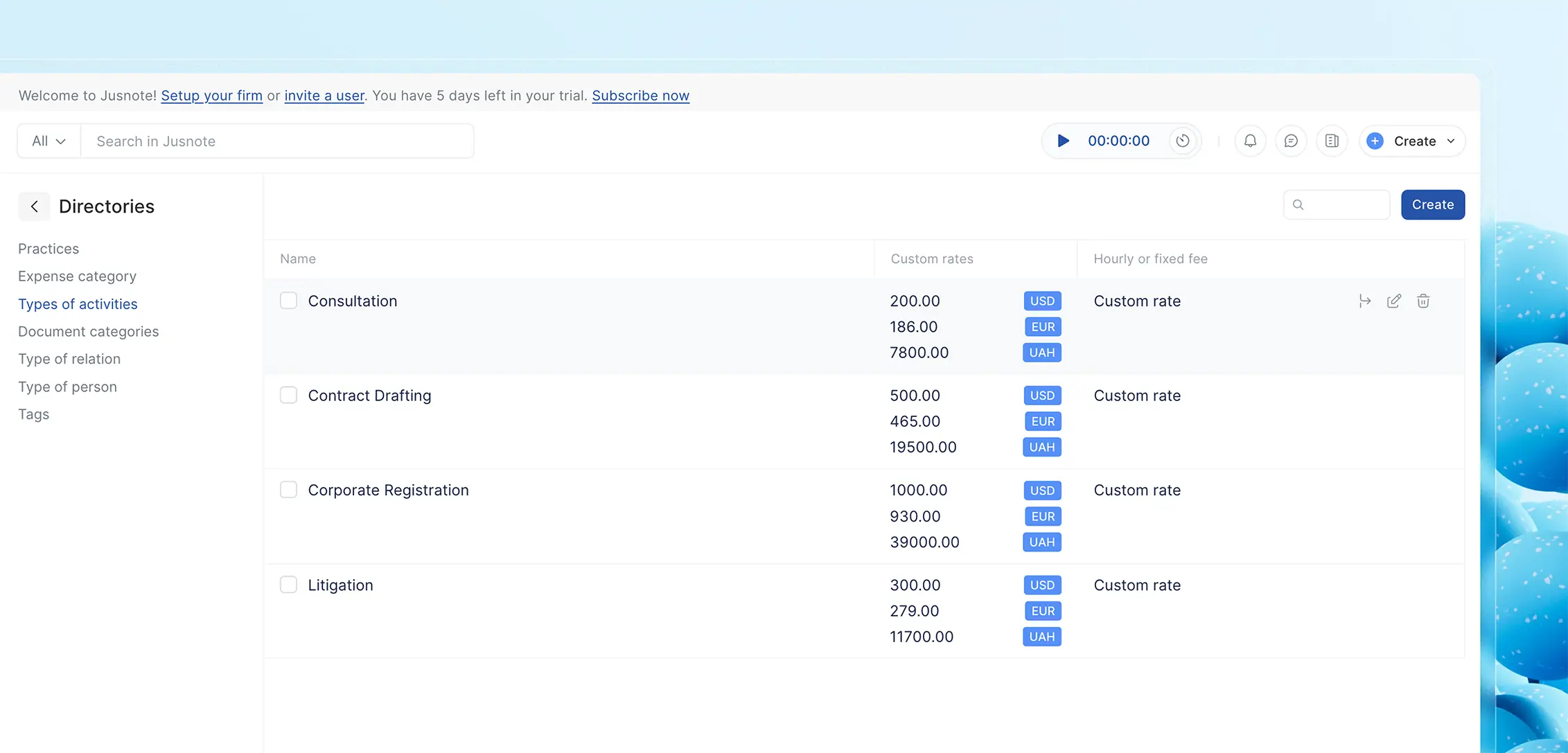

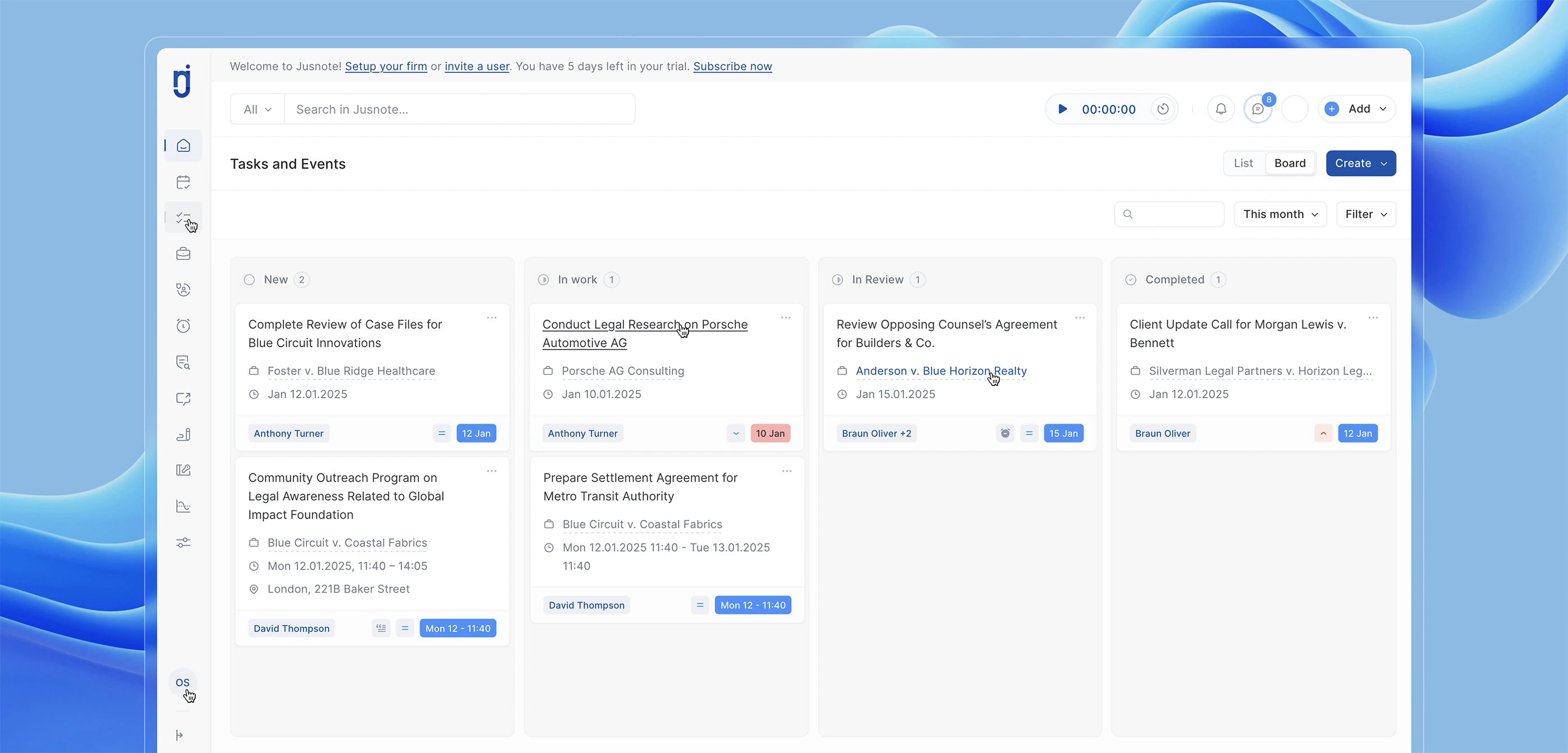

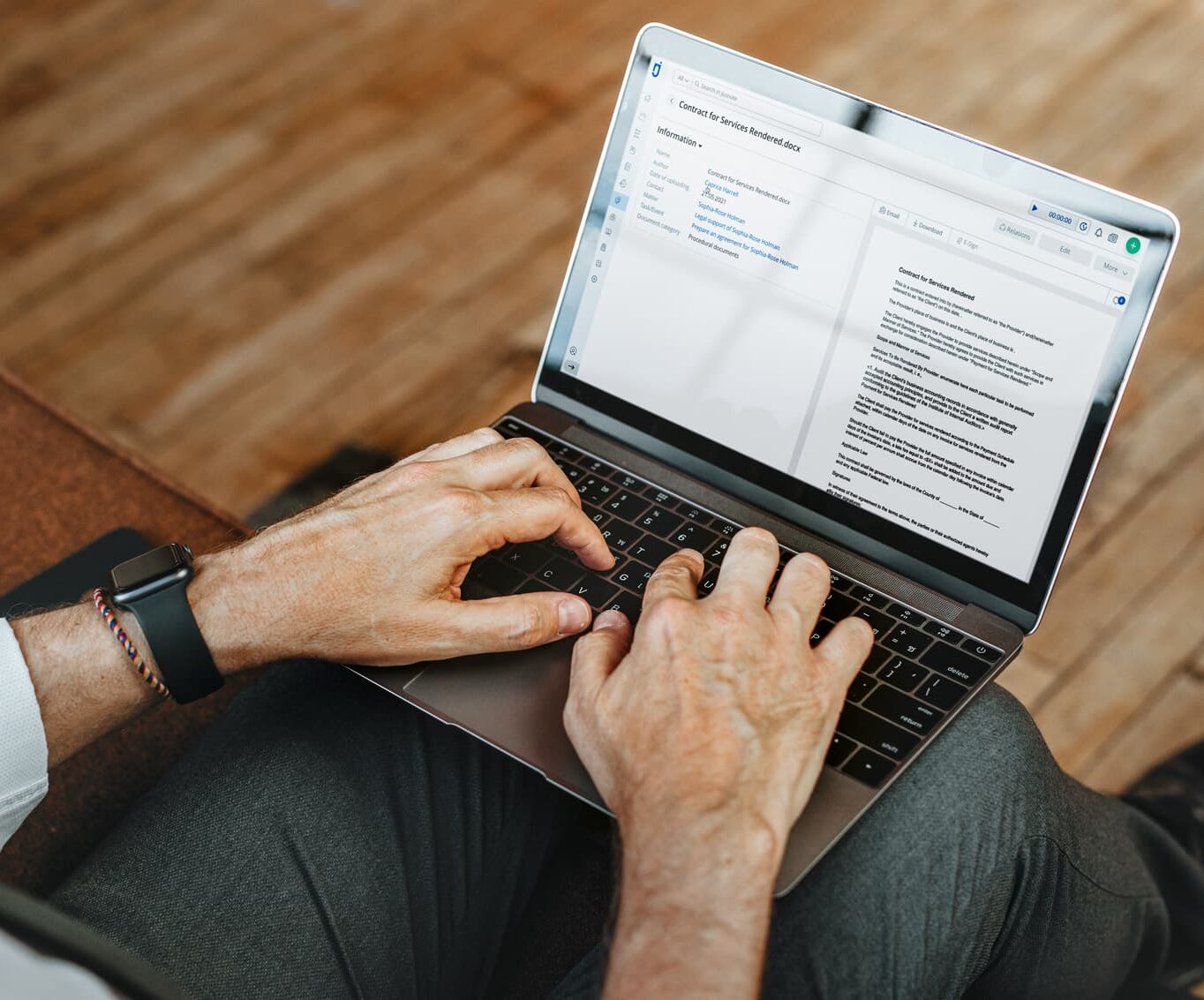

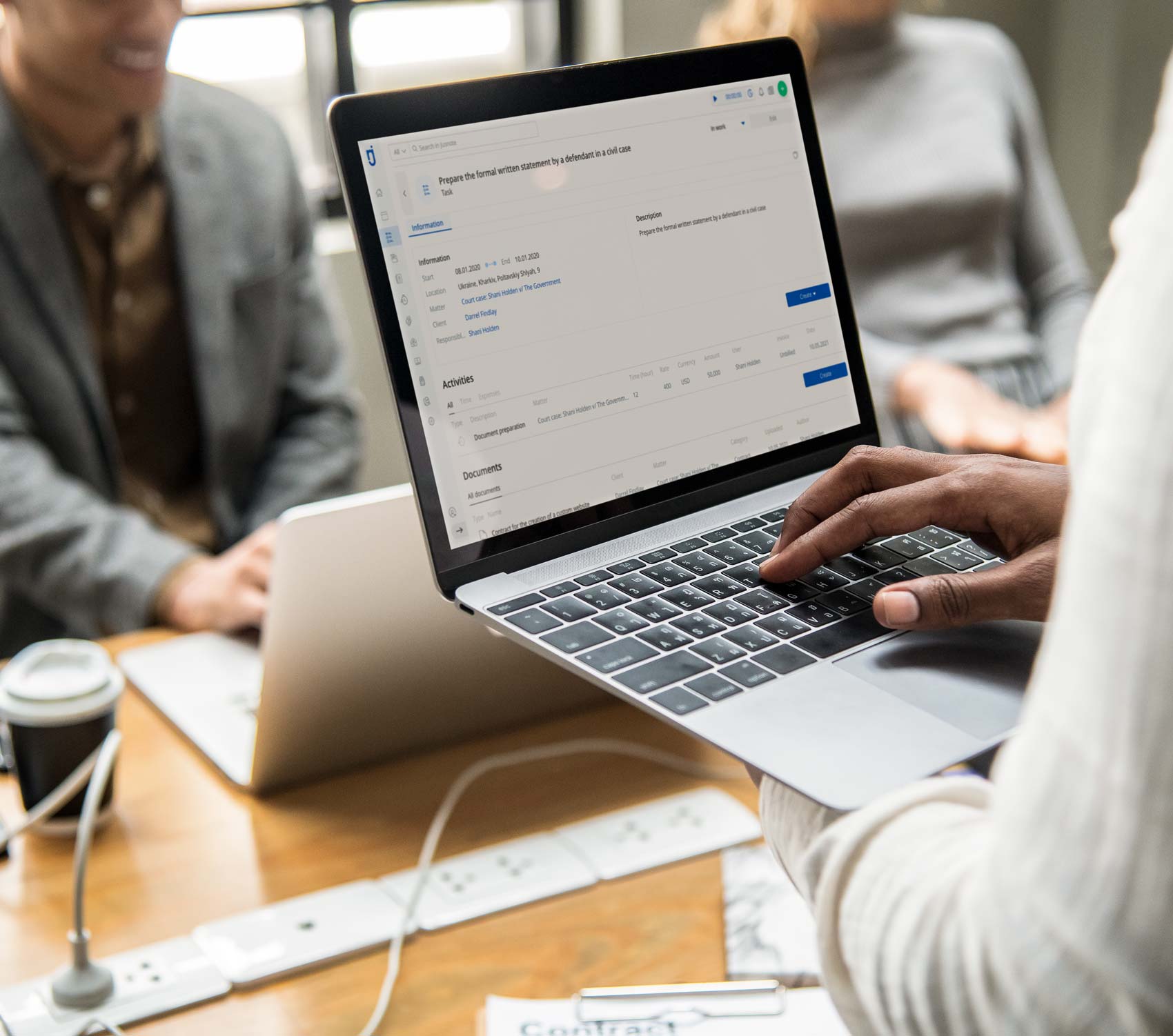

Given these benefits, law firms are encouraged to adopt specialized time-tracking tools, such as Jusnote, to make the process more convenient, automated, and less burdensome for the team.

Recommendations for Describing Completed Work in Reports

First: Detailed Task Descriptions

Every task assigned to a lawyer should be described with maximum detail. This ensures that during the client’s review or reconciliation process, there are no questions regarding the essence, logic, or results of the work recorded in the billing form. Clearly distinguish between tasks and activities (time entries) for greater clarity.

Important Note

Keep in mind that the final decision-maker for the services provided by a law firm is not always the same person who communicates with the firm on a daily basis. For example, daily interactions might occur with one authorized client representative, while reconciliation of data and payment approval is handled by another (e.g., an accountant, operations manager, or even the end client themselves). Reports on completed work must be drafted in a manner that is clear to all responsible parties on the client’s side, as well as to external specialists in case of a legal audit.

Second: Clear and Result-Oriented Billing Entries

Descriptions of completed work in billing forms must be clear and tied to specific results. Avoid abstract or vague descriptions without actionable details. For instance, entries like “Court appearance in commercial court,” “Organizing case materials,” or “Client contract review” lack specificity. Instead, include details such as the case number, court jurisdiction, or the specific client contract being analyzed.

Avoid using abbreviations, jargon, or slang that may not be understood by the client’s representatives reviewing or approving the report.

Third: Exclude Learning or Training Activities

Clients generally do not pay for activities related to a lawyer’s education or self-improvement, such as researching legislation or case law to gain knowledge for completing a task. Clients expect lawyers to be experienced professionals. Therefore, billing forms should not reflect activities that imply personal learning or training.

If a lawyer analyzes legislation or case law to execute a client’s assignment, it is advisable to separate this into two entries:

Time spent on studying legislative changes or analyzing recent case law should be billed as professional development (non-billable to the client).

Preparation of recommendations or an analytical memo for the client regarding risks based on the researched legislation or case law should be recorded as billable client work.

General Reporting Guidelines

Daily Completion of Billing Forms

To ensure data accuracy, each lawyer is advised to complete their billing form immediately after completing tasks for clients or internal firm assignments. This practice enables supervisors to access up-to-date information on time spent by employees at any given moment.

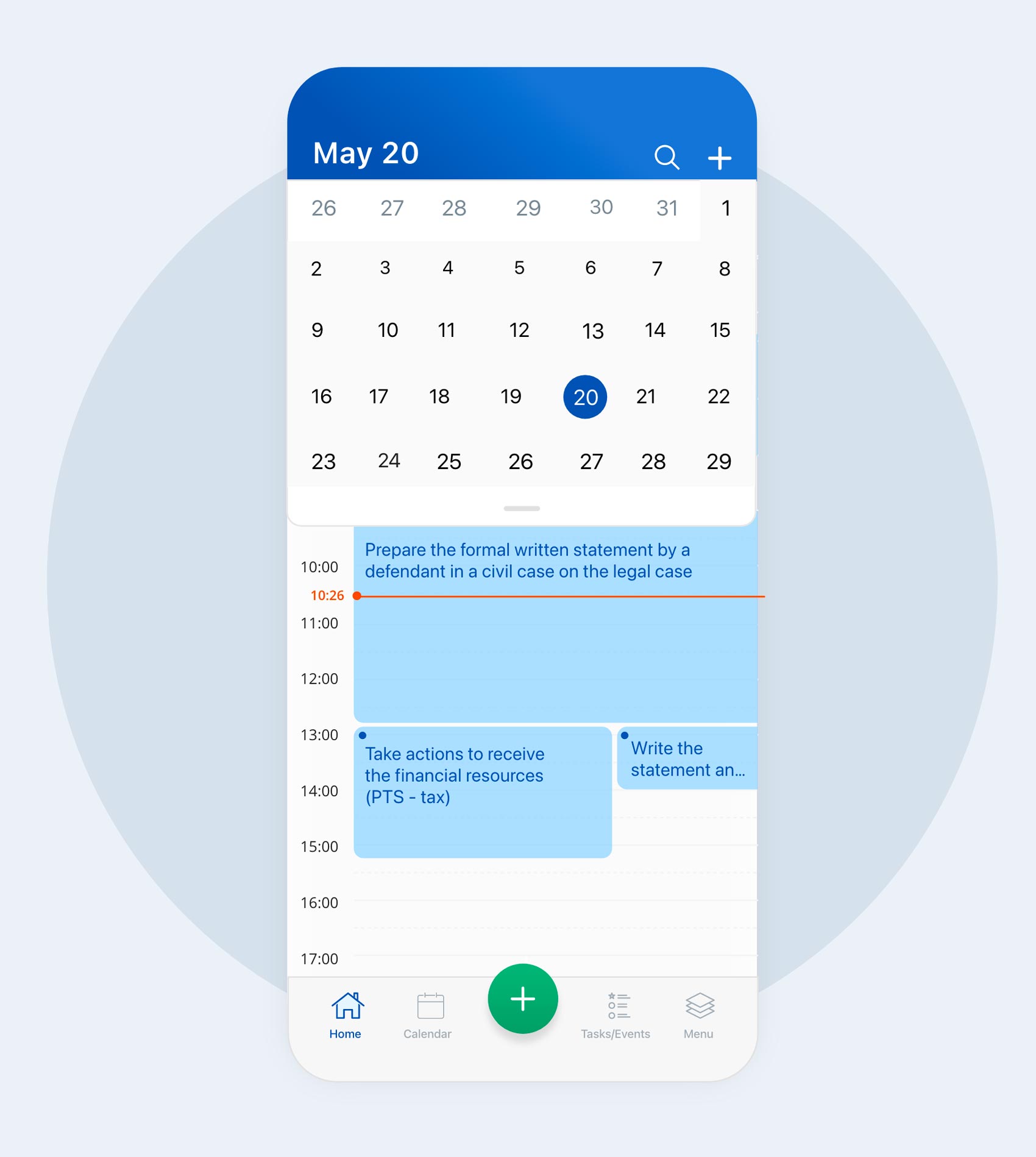

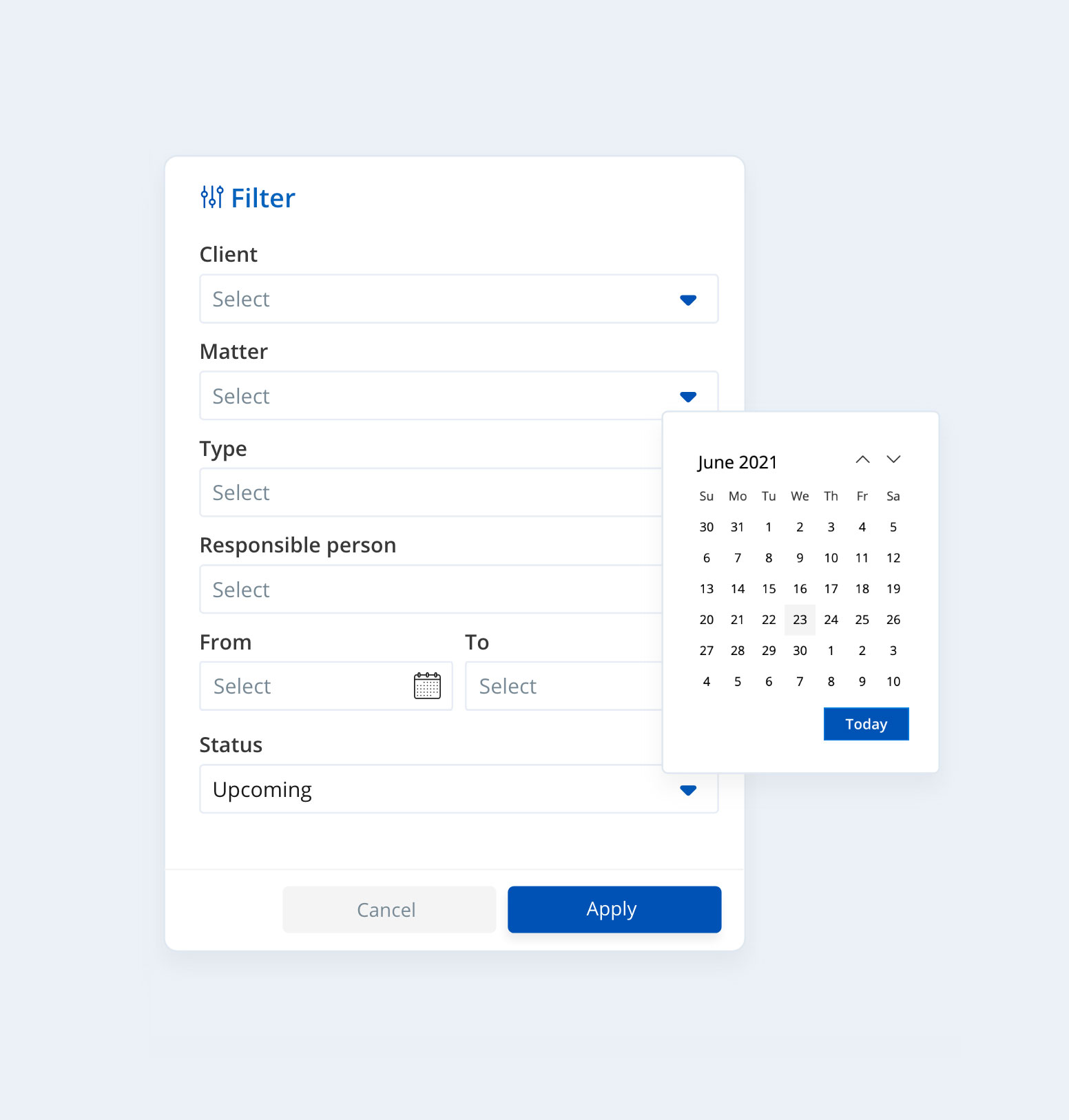

Filling Billing Forms When Away from the Office

In cases where a lawyer cannot complete their billing form during the day (e.g., due to business travel or external meetings), they should adhere to a strict deadline, such as no later than 10:00 AM on the next business day. Non-working hours due to illness, vacations, or personal circumstances must also be recorded in the system.To enhance convenience, especially during out-of-office work, it is recommended to use billing systems with mobile applications. These tools enable lawyers to log time entries in real time regardless of their location, improving the accuracy and timeliness of billing.

Timely and accurate completion of billing forms is not only a way to maintain precise work records but also a critical tool for increasing the firm’s revenue and reputation.

Jusnote Newsroom

Jusnote Newsroom  Search Newsroom

Search Newsroom

Back to all publications

Back to all publications